- Pure Protection Plans

- Investment & Protection Plans

- Difference b/w Both

A boy-in-squares bagging escapades of switching streets in groove & sensing musical airy-notes from 6 1". Under wayed nyctophile sketching the walls of life from the panorama of anime.

Reviewed By:

Sharan Gurve has spent over 9 years in the insurance and finance industries to gather end-to-end knowledge in health and term insurance. His in-house skill development programs and interactive workshops have worked wonders in our B2C domain.

Updated on Jul 02, 2025 3 min read

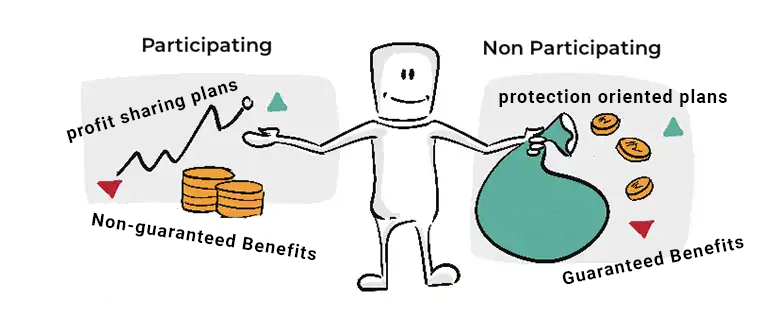

Differences Between Participating and Non-Participating Life Insurance

While purchasing anything, we always consider having options. Be it everyday groceries or buying expensive clothes. Wouldn't you agree that comparing plans while buying life insurance is essential too? However, people are always confused between participating and non-participating life insurance policies. You might come across these two terms, making you wonder what is the difference between both?

Let's understand how different these two are and how they can impact your life insurance journey.

What is a Participating Life Insurance Plan?

A participating life insurance plan comes with profit-sharing benefits, often referred to as a par policy. When you buy a participating life insurance plan, over the financial year, the company earns specific profits. The insurer pays you some part of the profit as a bonus or dividends via payouts annually, and you can use them to achieve your future financial goals such as:.

- Paying a premium for the following year.

- You can even deposit the amount with the insurance provider to get interest.

What is a Non-Participating Life Insurance Plan

A non-participating life insurance plan is solely protection-oriented, and neither does it provide any bonus or dividends from the insurer's profit. It is often referred to as a non-par plan. Under this plan, you do not get any dividend or additional annual payouts.

Please note that most non-participating plans provide a guaranteed maturity benefit. If you know you'll survive the policy tenure, opting for a non-participating life insurance plan would be best for you.

Comparison Between Participating and Non-participating Life Insurance Plans

| Participating Plans | Non-Participating Plans |

|---|---|

| The participating life insurance plan comes with profit-sharing benefits. The insurer shares the company profits with the policyholder as a bonus or dividend annually. | A non-participating policy is a contract between an insurer and policyholders where the insured pays premiums in exchange for a death benefit. Please note that these plans do not offer any dividend payouts and offer additional annual payouts. |

| Life insurance plans like endowment and money-back plans are considered participating plans. | A life insurance policy that offers a guaranteed payout at maturity is a non-participating insurance plan. |

| When the insurer earns certain profits, policyholders may receive dividends. This bonus can be used to pay remaining premiums, add-on optional covers, or be taken as cash. | Insured persons do not have a direct say in the company's operations or profit distribution. |

Key Difference of Par Vs. Non-Par Insurance Plans

Now, you may understand what the par and non-par policy is. Let's look at the key points that make both plans differ from each other:

-

Profits Share

Under a participating policy, you'll receive some part of the insurer's profit as a bonus or dividend against your policy. On the other hand, the non-par policy is a pure protection plan and does not offer any bonus or dividend annually. -

Guaranteed and Non-guaranteed Benefits

A non-participating policy offers a guaranteed payout at maturity. It is a contract between an insurer and policyholders where the insured pays premiums in exchange for a death benefit. On the other hand, a par policy offers guaranteed and non-guaranteed benefits against your policy.

Conclusion

Participating and non-participating life insurance plans are designed to serve the different needs of policyholders. Hopefully, with the details above, you'll understand the difference between both kinds of life insurance plans. For further assistance, you can reach out to our insurance experts at PolicyX and get an instant solution in no time.

Understand Participating and Non-Participating Life Insurance: FAQs

1. What is a non-participating policy?

A life insurance policy that does not offer any market returns, dividends or additional annual payouts but offers a guaranteed payout at maturity is a non-participating insurance plan.

2. Are par policies more expensive than non-par policies?

A par-term insurance policy typically costs even more than a non-par-term insurance policy due to the dividend payments.

3. Are premiums fixed in non-participating life insurance?

Yes, premiums are fixed in a non-participating term insurance plan based on the policy contract.

4. How are dividends used in participating life insurance?

Bonuses or dividends can be used to pay remaining premiums, add-on optional covers, or be taken as cash.

5. Do policyholders have a say in participating in life insurance?

Policyholders may participate in company decisions through voting or representation at annual meetings in participating life insurance.

Life Insurance Companies

Share your Valuable Feedback

4.6

Rated by 862 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Sahil Singh Kathait

A boy-in-squares bagging escapades of switching streets in groove & sensing musical airy-notes from 6 1". Under wayed nyctophile sketching the walls of life from the panorama of anime.

Do you have any thoughts you’d like to share?